What You Should Know About the 16th Amendment and Income Taxes

The Republicans would prefer destroying the U.S. & global economies instead of raising taxes on the wealthy

Issue #275 Government March 9, 2023

Today we are right in the middle of tax season, and it is also the day that President Biden reminded the Republicans that this is the deadline for submitting their proposal for the next budget.

On Tuesday, March 7, 2023, the president wrote an op-ed in the New York Times outlining the major points of his budget, including how to keep Medicare solvent for at least the next 25 years. (I have gifted the article to you at the link.)

On the other hand, the Republicans, who have yet to produce an actual budget plan, want to gut the nation’s foreign aid budget (especially for Ukraine) and make deep cuts to health care, food assistance, and housing programs for poor Americans.

Overall, President Biden and Vice President Harris strongly believe that all of their initiatives to "grow the economy from the bottom up and middle out," including the bipartisan Inflation Reduction Act that the Republican-led House was to eliminate, should be paid for by raising taxes on the wealthiest Americans, those whose incomes are more than $400K per year.

Senator Mitt Romney (R-UT), who is himself a multi-millionaire, immediately declared that Republicans would never vote to raise taxes. Instead, Republicans prefer to slash or completely eliminate benefits for middle- and low-income Americans.

Republicans are also deliberately conflating raising the debt ceiling to pay for previous government financial obligations with negotiating a new budget for the upcoming fiscal year.

If the Republicans do not raise the debt ceiling, the United States will, for the first time ever, default on its liabilities, sending the American and global economies into a tailspin.

The 14th Amendment to the Constitution specifically states that the United States cannot default on its debts.

Did House Speaker Kevin McCarthy ever have a complete reading of the Constitution as he promised? I didn't think so.

Now about those taxes:

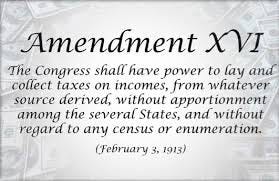

The 16th Amendment gives the federal government the authority to levy taxes on income from any source without apportioning it among the states and without regard to the census.

The income tax is now the largest source of Federal government revenue.

So. How did the 16th Amendment come about and what exactly does it do?

Why is this pertinent today?

Read the rest of the article to find out why.

We are changing the ratio of free vs paid articles per week. The rest of this article will be for paid subscribers only. Thank you for your support!

Keep reading with a 7-day free trial

Subscribe to We Are Speaking to keep reading this post and get 7 days of free access to the full post archives.