Issue #120 Education August 25, 2022

No ads or annoying popups ever! So instead, please see the important information at the bottom of this post. Thanks!

When I went to college several decades ago (I know, right?), my parents paid for my undergraduate degree, as well as those of my three sisters. (All four of us earned some scholarship assistance and worked part-time, too.) Both of my parents worked full time, but they “banked” all of my mother’s salary and the six of us lived off of my father’s salary. It was much easier to live on one salary back then, plus my mother could squeeze a penny so hard, it made Ol’ Abe cry!

However, for my Master’s degree, I took out student loans. I remember paying them back every month, but the payments were not unrealistic. Plus, because I was a teacher, after working in education for five years, the remainder of my loans were forgiven.

Most importantly, the cost of college was not astronomical as it is today, the interest amounts were not as high as they are now, and the lenders were not the predatory types many of them are today.

Boston College history professor Heather Cox Richardson reminds us in her Substack publication of the important difference between the affordability and availability of a college education from 1945 - 1980 and today:

The (Biden) administration’s plan is a significant pushback against what has happened to education funding since the 1980s. After World War II, the U.S. funded higher education through a series of measures that increased college attendance while also keeping prices low. Beginning in the 1980s, that funding began to dry up and tuition prices rose to make up the difference.

A college education became crucial for a high-paying job, but wages didn’t rise along with the cost of tuition, so families turned to borrowing. Many of them choose the lowest monthly repayment amounts, and some put their loans on hold, meaning their debt balances grow far beyond what they originally borrowed. The shift to “high-tuition, high-aid” caused a “massive total volume of debt,” Assistant Professor of Economics Emily Cook of Tulane University told Jessica Dickler and Annie Nova of CNBC in May. Today, around 44 million Americans owe about $1.7 trillion of educational debt.

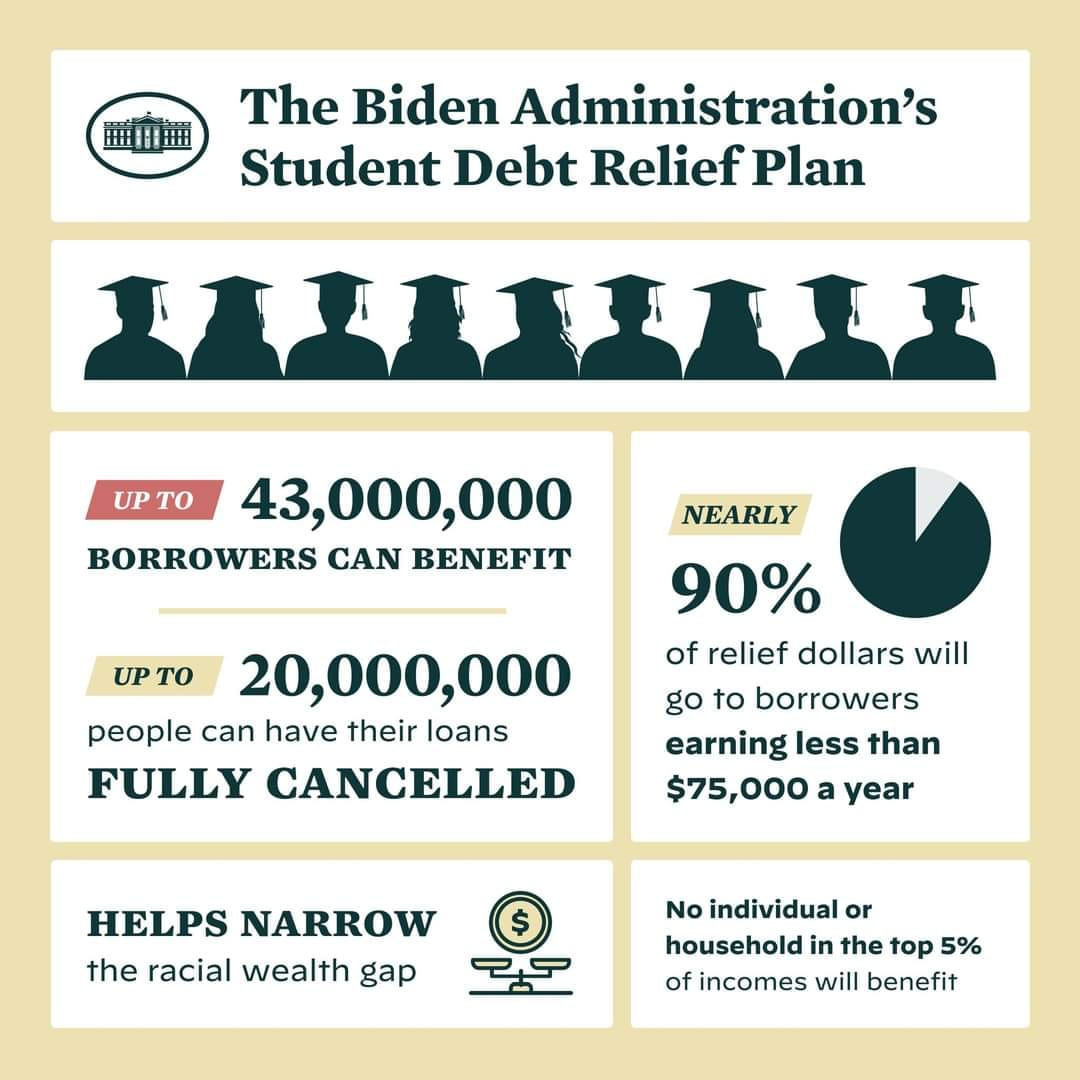

President Biden issues an executive order to forgive or reduce up to $20,000 in student loans for people making less than $125,000/year—a total of 43 million Americans.

This was a campaign promise that he made. People who received Pell Grants can receive up to $20,000 in loan forgiveness, while those without Pell Grant loans receive up to $10,000 in loan forgiveness. For those who will still have some loan debt, this program ensures that the cost of the loan payments, including interest, will be cut in half.

Many people wish that a greater amount of loans could have been forgiven, but there was only so much Biden could do by executive order.

If the Democrats gain a larger majority in Congress after the midterms, which now seems a possibility, more relief can be completed by new laws instead.

The plan also includes Parent Plus loans, so borrowers whose families had to take out debt on their behalf will be included as well.

It halves monthly payments for those on income-driven repayment.

90% of the benefits of Biden’s student loan forgiveness plan go to those making under $75,000.

Earlier in August, the Biden administration granted full, automatic loan forgiveness totaling about $32 billion to students who were scammed by predatory loans by several for-profit schools, including ITT Tech, Corinthian College, Kaplan Career Institute, and DeVry University.

The Relief Plan has three parts

Part 1. Final automatic extension of the student loan repayment pause

Loan payments have been paused since the beginning of the Biden administration because of the pandemic. Payments will resume in January 2023.

Part 2. Debt relief is targeted to low- and middle-income families

In addition to the relief detailed above, borrowers who are employed by non-profits, the military, or federal, state, Tribal, or local government may be eligible to have all of their student loans forgiven through the Public Service Loan Forgiveness (PSLF) program.

Part 3. Make the student loan system more manageable for current and future borrowers

Borrowers will now pay no more than 5% of their monthly discretionary income on undergraduate loans. Previously, the amount was 10%.

Raises the amount of income that is considered non-discretionary and is protected from non-payment.

Forgives loan balances after 10 years of payments, instead of 20 years, for borrowers with loan balances of $12,000 or less.

Cover the borrower's unpaid monthly interest, so that, unlike other existing income-driven repayment plans, no borrower's loan balance will grow as long as they make their monthly payments—even when that monthly payment is $0 because their income is low.

Biden isn’t just forgiving a set amount of debt. He is also enacting a new policy that ends excess interest on student loans—as long as a borrower pays their minimum monthly payment (now capped at only 5% of their income), their balance will no longer increase.

A full description of this new plan is available from the Federal Student Aid Department of the U.S. Department of Education.

Knee-jerk reactions from the right-wing politicians as well as just plain selfish people

As expected, because this is what they do. This program helps primarily low- and middle-class Americans, so rich right-wing Republicans immediately jumped to call this plan “socialism,” just as rich right-wing Democrats did in the 19th century when the idea of using taxes paid by rich people would help to build roads for everyone.

"President Biden’s student loan socialism is a slap in the face to every family who sacrificed to save for college, every graduate who paid their debt, and every American who chose a certain career path or volunteered to serve in our Armed Forces in order to avoid taking on debt," (multimillionaire) Senate Minority Leader Mitch McConnell said Wednesday.

Sad to see what’s being done to bribe the voters. Biden's student loan forgiveness plan may win Democrats some votes, but it fuels inflation, foots taxpayers with other people’s financial obligations, is unfair to those who paid their own way & creates irresponsible expectations.

(multimillionaire) Senator Mitt Romney

It is also staggering, but not surprising, how many people said: “I struggled and paid back my loans, why do I have to pay for the loans of losers?” “If they couldn’t pay their bills, why did they choose to go to school?”

REPORTER (at the press conference): Is this unfair to people who paid their student loans or chose not to take out loans?

BIDEN: Is it fair to people who, in fact, do not own multi-billion-dollar businesses if they see one of these guys getting all the tax breaks? Is that fair? What do you think?

President Biden also had some choice words for the hypocrisy of Republicans:

“We’re holding colleges accountable for jacking up costs without delivering value to students … My predecessors looked the other way, for some reason.”

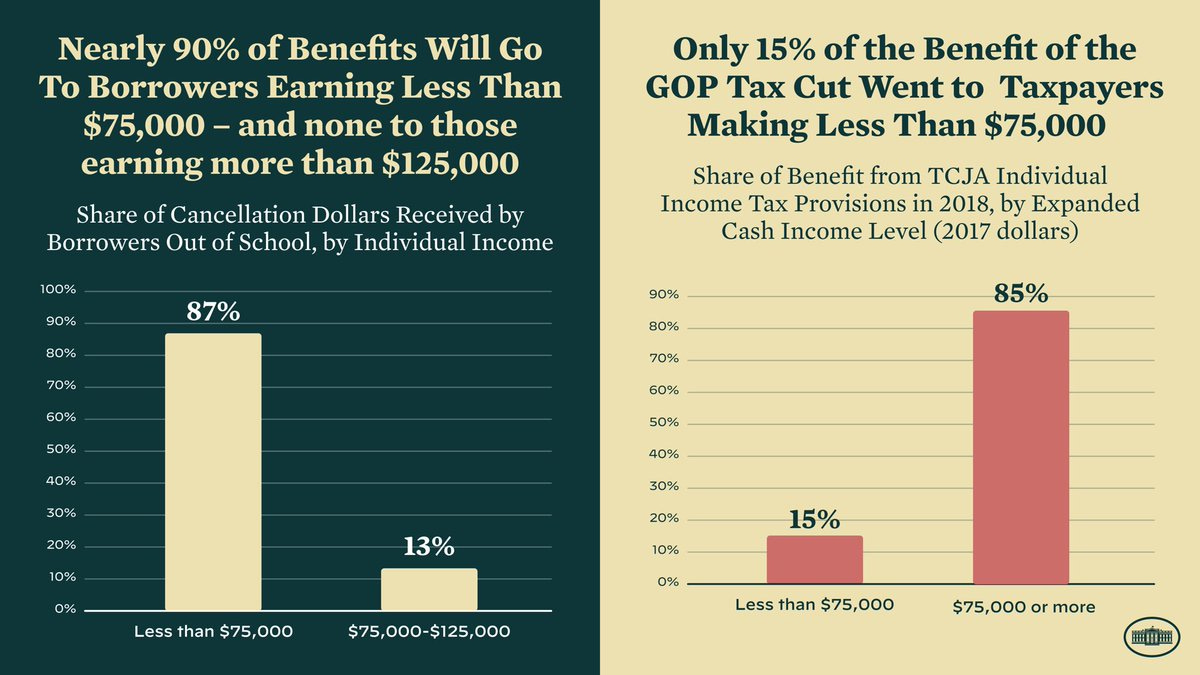

To Republicans’ hypocrisy in supporting a 2017 tax cut for the wealthy, but opposing student debt relief:

"I will never apologize for helping working Americans ... Especially not to the same folks who voted for a $2 trillion tax cut."

The Difference between Recipients of Student Loan Relief vs 2017 Tax Cuts

Trump thinks that defaulting on his loans makes him “smart”

Republican millionaires didn’t complain when their PPP Loans were forgiven

What do you think about this Executive Order? Will it affect you directly or indirectly? Let us know in the comments!

Help us to grow!

“We Are Speaking” is a reader-supported publication. To receive new posts and podcast episodes and to support our work, consider becoming a free or paid subscriber. We publish 7 days/week and 28+ issues/month. You. can upgrade your free subscription to the paid level. It costs monthly and annual paid subscribers less than 35¢ an issue. Thank you!

Thank you for checking out some of the books and businesses of the TeamOwens313 Global Creative Community:

Detroit Stories Quarterly (DSQ) Afro-futurism Magazine

The Mayonnaise Murders: a fantasy mystery novel by Keith A. Owens

The Global CREATIVE Community (GCC) Facebook Group for Independent Writers and Creative and Solo Professionals

The Global Creative Community (GCC) Private Membership Group for Independent Writers and Creative and Solo Professionals

The Global Creative Community Brand and Marketing Academy: Training and Group Coaching for Independent Writers and Creative and Solo Professionals

Pam’s Branding and Marketing Articles for Independent Writers and Creative and Solo Professionals on LinkedIn